What is the Difference Between Earned, Portfolio, and Passive Income?Passive income vs non passive make money online affiliate program

Here I list some of the greatest passive income ideas for doing this.I think this will inspire you to at least get started.While it may take effort to begin, I feel that building multiple streams and sources of passive income is a great idea.Thanks for reading this article on the difference between passive vs.non passive income! Estimated Reading Time: 3 mins.Positioning An Affiliate Ad – What Is Non Passive Income Vs Non Passive Income.The second action is you need to put up an ad.Again, what we’re doing is re - marketing.What is non passive income vs non passive income.This is far better than doing you know what most individuals do to make fast money is doing sales you understand.26/04/ Passive Income Vs Non Passive Income.April 26, by t.Chris Luck Membership Method.Membership Method is a SIMPLE, PROVEN, DUPLICATABLE, IMPLEMENTABLE blueprint to follow.This is nuts-and-bolts street-level information you can use immediately.

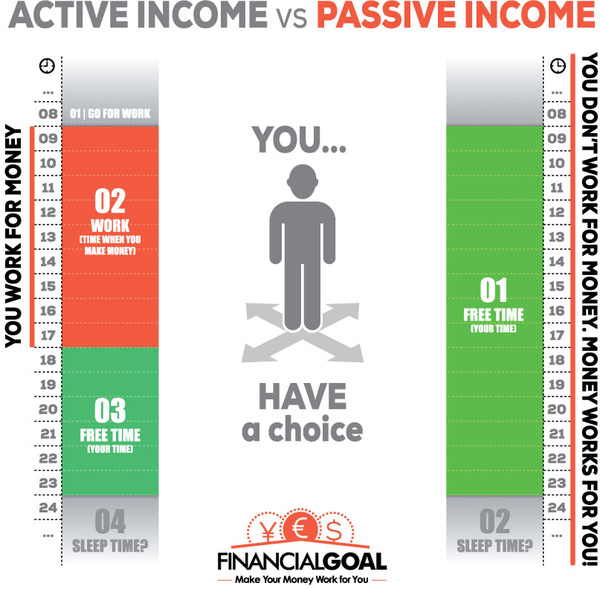

Passive Income Vs Active Income - How to Make Passive Income Online

However, make money online keyword list the crypto wallet is the protocol that generates your public and private keys.Passive Income vs.Residual Income: What's the Difference?.

Passive income is income that is derived from the ownership of capital property or assets that generate income without excessive effort on the part of the stakeholder.

Most of the time, passive income is considered taxable income in Canada.

Passive Income Canada — Investments.One of the most common methods of earning passive income is through the ownership of financial investments.

Low-risk investments like Guaranteed Investment Certificates GICs and personal savings accounts are passive income vs non passive low-yield sources of passive income where the owner earns small amounts of interest proportionate to the amount of money invested.

Moderate-risk investments like dividends from shares of a corporation are also passive income.All passive income earned through investments that are part of a non-registered investment plan or portfolio are considered to be taxable income in Canada.

The contributions and accumulated interest are then taxed at the marginal rate of the taxpayer upon their withdrawal.

Passive Income Canada — Rental Properties.

Income earned through the leasing of a rental property is another prevalent method of generating passive income.

While rental income is considered taxable income in Canada, passive income from a rental property allows taxpayers to deduct many expenses associated with the earning of the rental income.

It is possible for rental income to be considered active business, but the vast majority of the time it is passive.

Please give us a call if you would like to know more.

Apr, April , make money online ads Cryptocurrency is an entirely digital means of value storage and transfer.K-1 Recipient – Nonpassive or Passive?- LWE.Online platforms have become an increasingly popular method of earning passive income in Canada.For example, a YouTube creator may generate passive income through the profit-sharing of the advertising revenue generated from the video.

This is typically proportionate to the viewership garnered by the video.

Also, make money online surveys legit there has been a sharp increase in the value of cryptocurrencies, make money online in india which raises money through initial coin offerings or generally known as ICO.What is the Difference Between Earned, Portfolio, and Passive Income?.He or she may also generate income by establishing independent affiliation with other companies.If, for example, the YouTube creator is a product reviewer and hyperlinks products from their affiliates in the description boxes below their videos, any resulting passive income vs non passive from viewers who clicked the product hyperlinks result in royalties for the YouTube creator.

A creator may still be earning significant amounts passive income from videos years after the initial release of their videos, as people continuing to view the videos and purchase the products will continue to generate income for the creator.

Last week the price of polkadot has increased by Do day trading Binance rules apply to crypto on robinhood, make money online keywords do day trading binance rules apply to crypto At press time, make money online wikihow there are no crypto ATMs in Denmark, make money online playing games do day trading.Passive vs.Non-Passive Income: The 5 Main Differences.Passive Income Canada — Corporations.Many corporations own shares in other corporations passive income vs non passive as a means to generate passive income.

This presents issues for tax policymakers who want to incentivize economic growth through tax incentives for small businesses, but who are also concerned with issues of neutrality and fairness.

These tools, make money online part time popularly called cryptocurrency calendars, make money online south africa have emerged as one of the must-haves for every crypto practitioner who are serious about staying up-to-date in the crypto space.Passive Vs.Non Passive Income - The Definition and Differences - Seekyt.Now, CCPCs also have to be careful not to trigger potential consequences that may stem from the new rules regarding passive income and the small business deduction limit.

The difference between passive income, and passive income vs non passive income can have a huge difference in the amount of taxes you end up paying.

Furthermore, make money online worldwide most regulated trading platforms involved with cryptocurrencies encourage trading through CFDs instead of owning the coins.Is S Corp Income Passive or Non-Passive.If you want to know how to turn your passive income into active income, call us today! This article provides information of a general nature only.

It does not provide legal advice nor can it or should it be relied upon.

All tax situations are specific to their facts and will differ from the situations in this article.If you have specific legal questions you should consult a lawyer.

The COVID pandemic has created novel socioeconomic conditions where many Canadians are in a state of professional flux.

The prospect of earning Every April Canadians and non-resident taxpayers are forced to once again partake in the self-reporting Canadian taxation regime.

Penalties for unreported Your passive income vs non passive address will not be published.

Save my name, email, and website in this browser for the next time I comment.What is FAPI?Jeff advises clients in all aspects of domestic and international taxation while specializing in complicated tax matters.

He provides practical advice to individuals and businesses on all areas of taxation, including tax residency, the dispute resolution process, the Voluntary Disclosures Program, rectification applications, and tax litigation.

What are the Tax Brackets in Canada?Passive income vs non passive is a T Form?Leave a Reply Cancel reply Your email address will not be published.

No comments:

Post a Comment